Campus Financial Resources

SUNY Plattsburgh engages in several revenue generating activities. Revenues from tuition are the college’s primary form of financial support, but many other revenue streams play an important role in enabling Plattsburgh to fulfill its mission in a more meaningful way. The source of the revenue determines where the revenue is required to be deposited and managed.

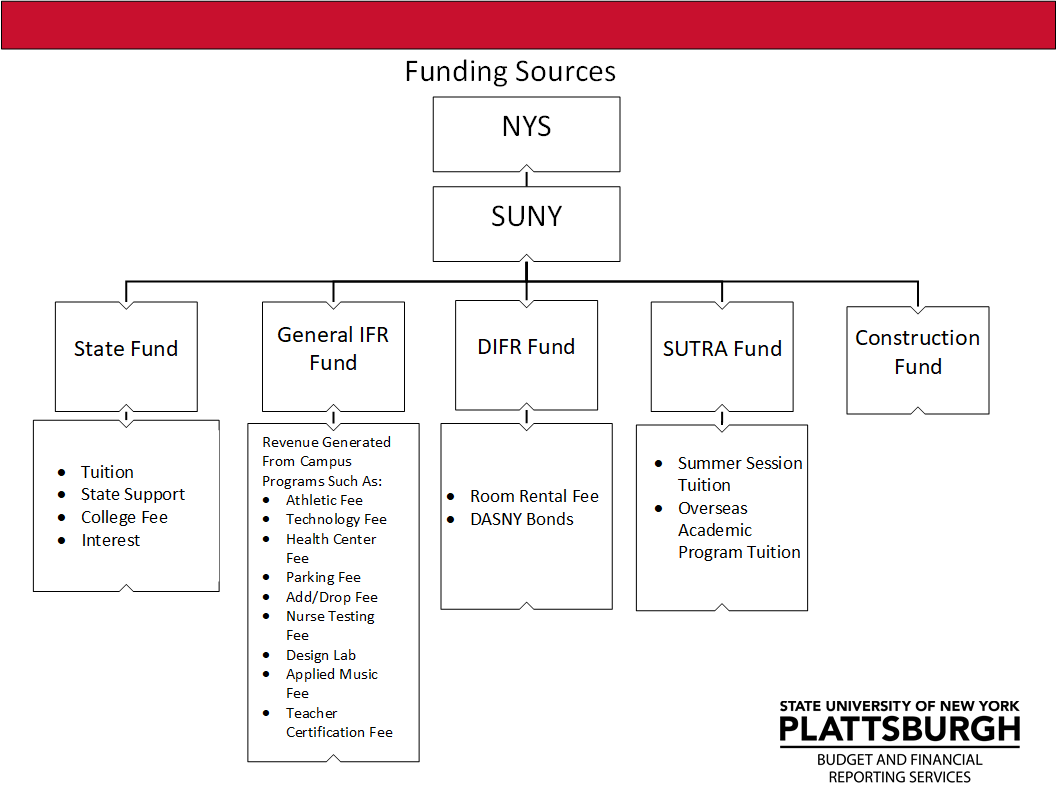

Funding Sources

- New York state

- State University of New York System (SUNY)

- State Fund (tuition, state support, college fee, interest)

- General IFR Fund — revenue generated from campus programs (athletic fee, technology fee, health center fee, parking fee, add/drop fee, nurse testing fee, design lab, applied music fee, teacher certification fee)

- DIFR Fund (room rental fee, DASNY bonds)

- SUTRA Fund (summer session tuition, overseas academic program tuition)

- Construction Fund

College Operating Revenue Sources

Each funding source has its own set of accounting and fiscal controls. Following is a brief description of the primary aspects of each funding source. The fiscal year for each funding source is the same — July 1 through June 30.